The president of the United States, Donald Trump will be meeting the president of China, Xi Jinping this weekend in Argentina at the Buenos Aires on the sidelines of the G20 summit.

There are tentative signals that the two presidents might be successful in striking a deal but according to Goldman Sachs’ analysts, escalation of the trade war between the two nations is the most likely outcome of the meeting between the Presidents of the United States and China.

The team at the Goldman, which was led by Andrew Tilton stated in a note that currently they see “escalation” in the next few months as the most likely outcome with a probability over 50 percent.

According to the report, this scenario would lead to increase in the rates of tariff of all the imports to 25 percent along with further extension of the range of tariff on the goods of China.

Whereas the less likely outcome according to the Goldman Sachs is the other option which would be that there is either a “pause” or a “deal.”

In a statement, the bank stated that there are least chances of only 10 percent of a comprehensive deal in the near future but this increases in the course of 2019.

It further added that they believes by the end of 2019 the trade war between the United States and China will at the least reach the state of “pause.”

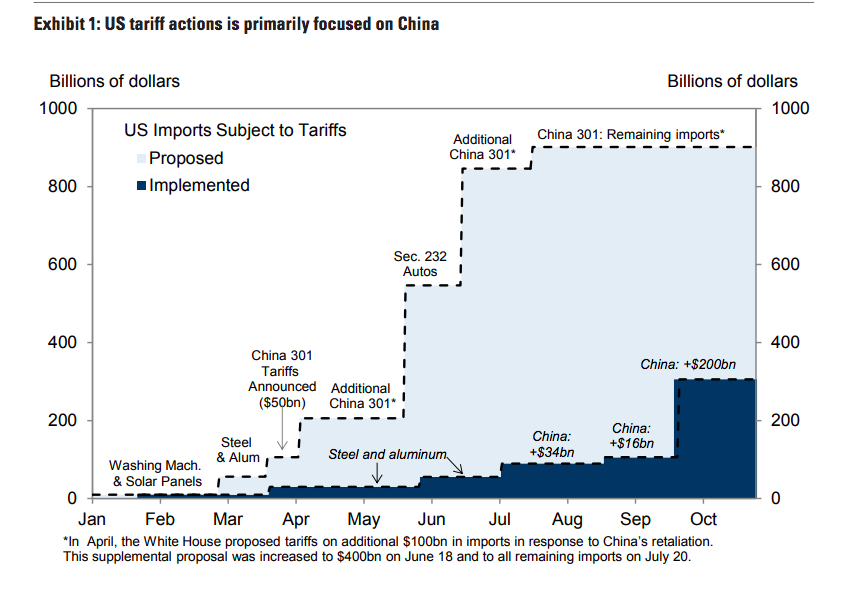

There has been a heavy imposition of tariffs by the administration of the United States to the imports of Chinese goods which have a value of $250 billion, in reply to which, China has imposed tariffs of worth $110 billion on the goods of US.

This imposition of heavy taxes has affected adversely the economy of the entire world along with their own and the economy of the world is waiting for the trade war to come to an end.

Source: BusinessInsider, USAToday