You are not the only one who recently realized you can barely afford a regular Frappe with Almond Milk. It makes you feel like you’re in France. We can live without that. The prices of basic goods are going up. It is just a question of weeks if not days to get a large grocery bag.

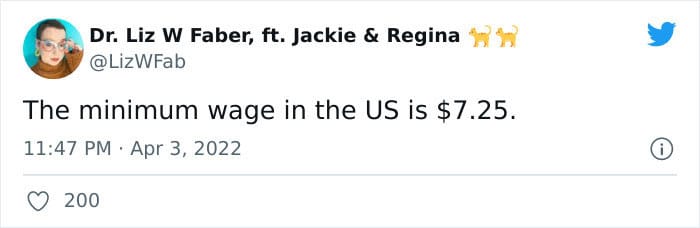

$5200.That is the amount of money we need to add to our budget a year to make up for inflation. The inflation tax will come from higher-priced food and energy. The extra $433 per month is on the same goods and services as last year.

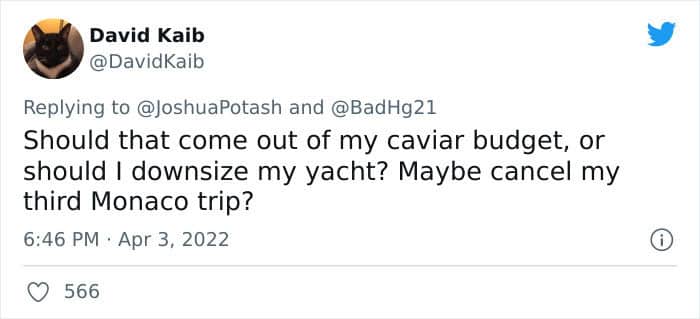

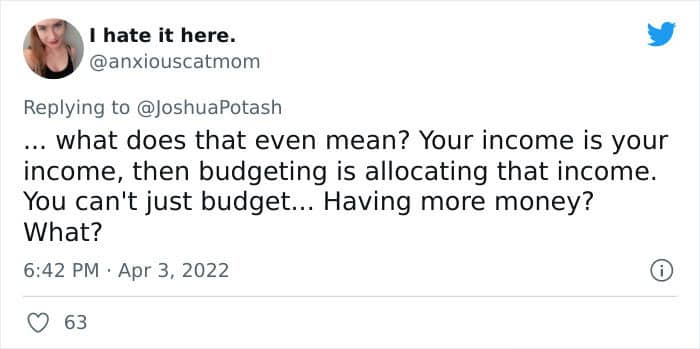

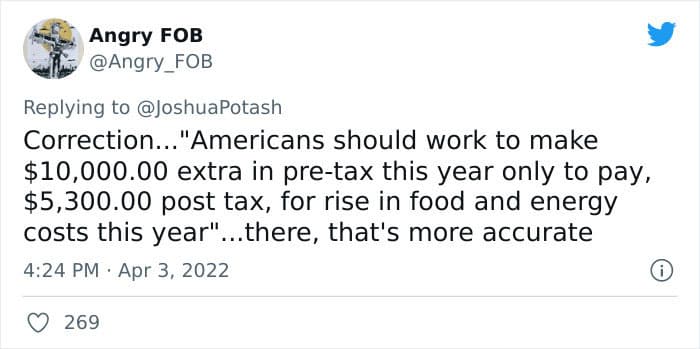

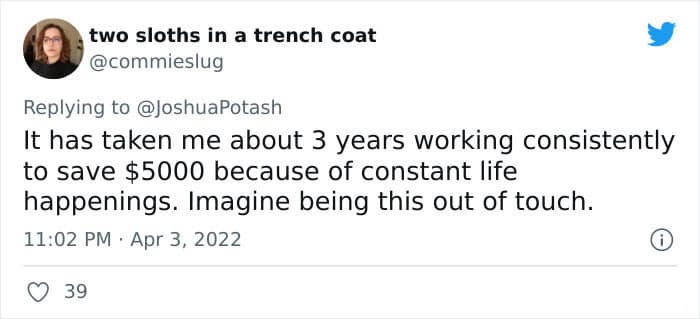

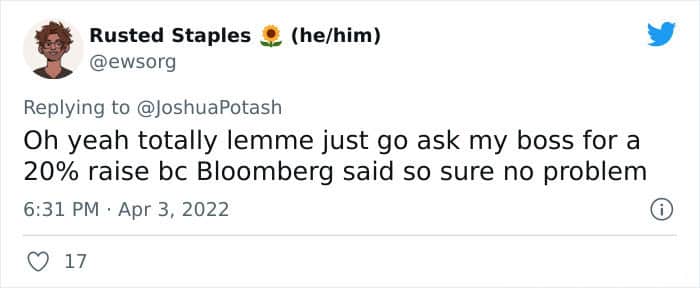

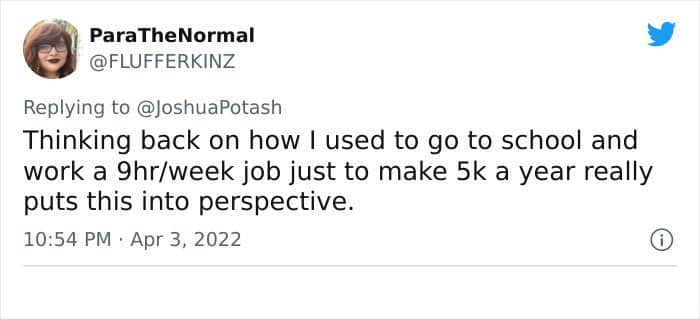

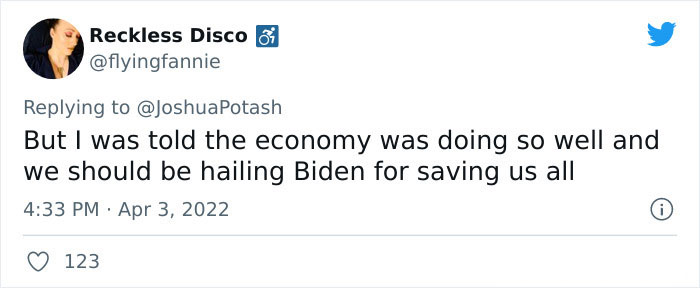

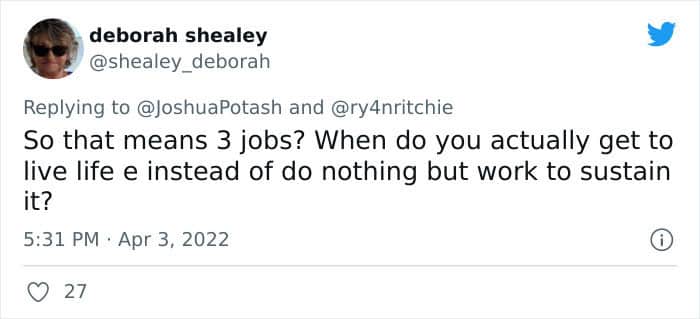

The headline went viral on social media and in no time, sarcastic reactions flooded the internet. “Should that come out of my caviar budget, or should I downsize my yacht?” tweeted David Kaib. Another person suggested “making the third home a rental property.”

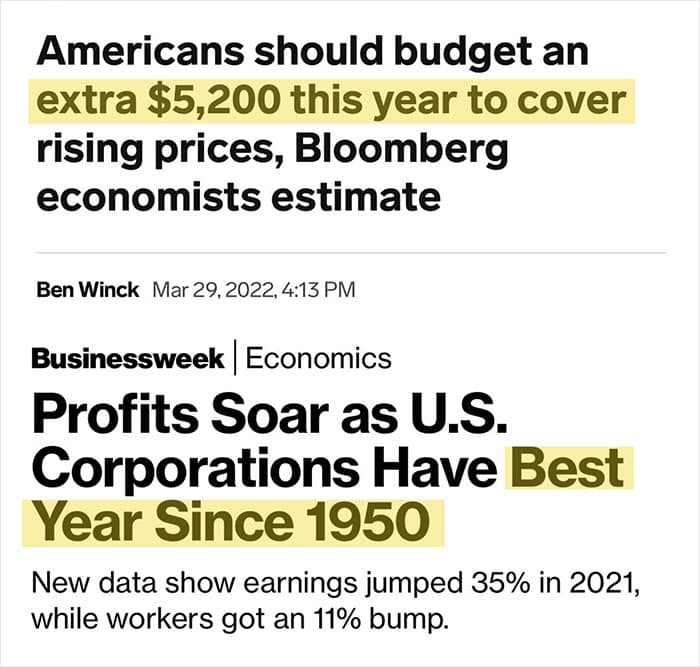

Corporations made their best year since 1950 in 2021, with record profits. From this point on, I just leave the stage to people on social media.

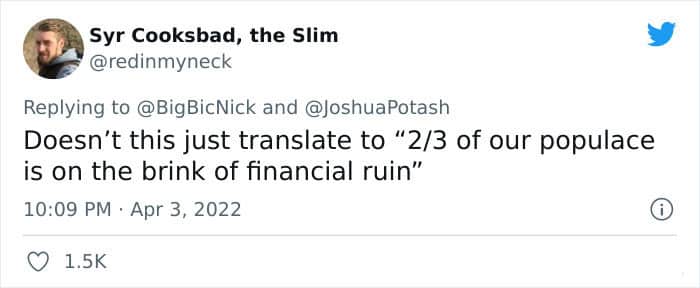

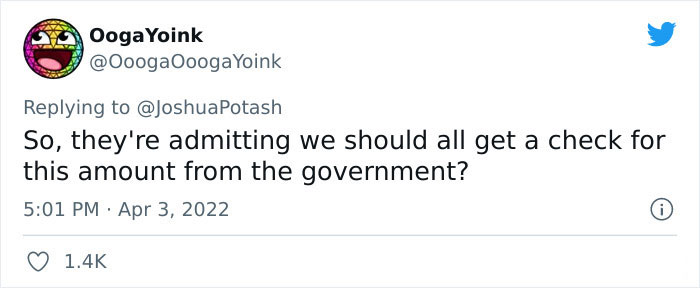

Everyone is raising their eyebrows after it was reported that Americans should budget an extra $5,200 this year to cover rising prices.

Andrew Husby and Anna Wong were quoted as saying that in a Tuesday article.

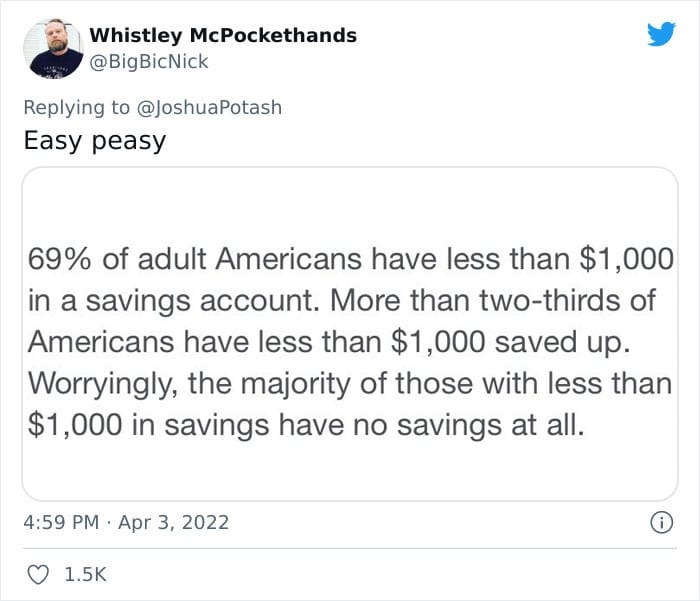

The red-hot inflation expected to last throughout the year will leave the average US household spending $5,200 more than it did a year ago. They commented: “Accelerated depletion of savings will increase the urgency for those staying on the sidelines to join the labor force, and the resulting increase in labor supply will likely dampen wage growth,” they said.

According to Business Insider, “as people spend their built-up savings, they’ll need to go back to work, and employers won’t have to pay as much to lure them back.”

While many American households worry about how they will afford basic things like fuel, heating, and groceries, major U.S. Corporations can not relate. They seem to be riding out the fiercest inflation in 40 years like a walk in the park.

The news headline said that US corporations saw record profits and that it was the best year since 1950.

According to new data from the Commerce Department, corporate profit margins are the largest they have been in 70 years.

In an interview with NPR, a professor of economics said that companies always want to maximize profits. “In the current context, they suddenly cannot deliver as much anymore as they used to. And this creates an opening where they can say, well, we are facing increasing costs. We are facing all these issues. So we can explain to our customers that we are raising our prices,” she said. No one knows how much should be increased.

This didn’t sit well with people on the social networking site who were quick to share their sarcastic reactions.

Moreover, Weber argues that as a matter of fact, “what we have seen is that profits are skyrocketing, which means that companies have increased prices by more than cost. In the earnings reports, companies have bragged about how they have managed to be ahead of the inflation curve, how they have managed to jack up prices more than their costs and as a result have delivered these record profits.”